|

THIS COULD BE A BIG YEAR FOR JAPAN'S GIRL POWER The ladies of Nagatacho are ready to take on the challenge to become Japan's first female Prime Minister. But, there is one lady who could completely take the spotlight if she were to return to national politics; Tokyo Governor Yuriko Koike This has not yet been published on Patreon or Substack. To read this please send me a message HERE

0 Comments

I have been thinking about the ‘risk off’ last week, or at least the positioning in the markets that would suggest weaker equities, stronger oil, stronger dollar, stronger gold and rising interest rates, and I’m not entirely convinced. With the current scenario focused on war in the Middle East, in this note I take a quick look into the archives of 1991 and “Desert Storm”. It is entirely possible this war positioning catches everyone out. I was ill during the Gulf War in 1991, stuck at home with glandular fever. I watched the whole thing more or less live on TV, with advertisements and some MTV. It was a first. Perhaps this is a second. Happy hunting! To read this article in full on Patreon click HERE

After what has been perceived by the press and the Japanese Government as decades of indifference, retail investors are starting to look at domestic stocks and the new NISA accounts are acting as a catalyst. It is early data, but there is evidence of a start of re-engagement with stockbrokers. Click HERE to read the article in full on Patreon Meiji Some observations and thoughts on the Japanese market for January 2024 and into March.

And a big month for the Bank of Japan, Retail Sales and chocolate shaped earbuds. To read this article, please click HERE The Global Combat Air Programme (GCAP) sees the United Kingdom (UK), Italy and Japan work together.

I believe there is a likelihood now that the downside in the yen could be pegged by the MoF. There are a number of good reasons, but perhaps the most important is that investors and partners with Japan need to be comfortable with their investments, and encourage more capital to flow into Japan. If they get it right, MoF could make a tidy profit in the process. Click HERE to read the article in full on Patreon

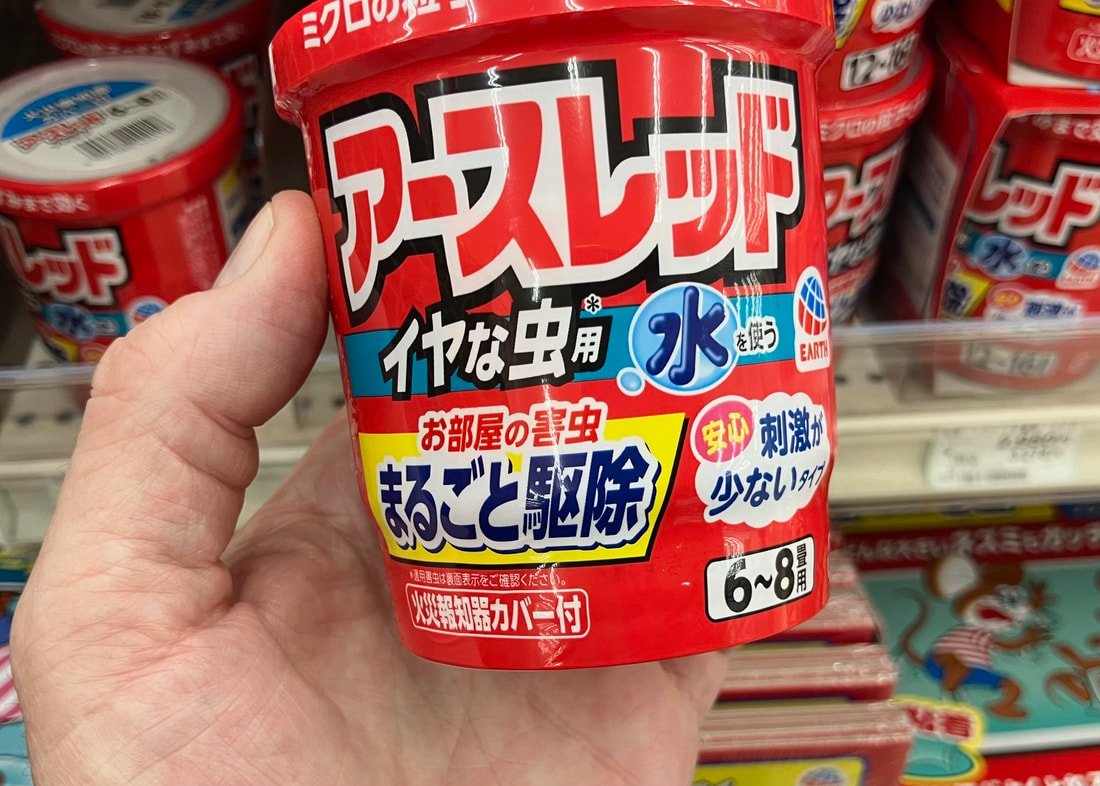

To read this article, please click HERE A Japanese "Bug Bomb" that kills most every creepy-crawly at home but requires a proper clean-up afterwards.

Sleep tight, don’t let the bedbugs bite. Japan saw more reports of bedbugs in 2023 than ever, but not yet at the levels that has been reported in other popular tourist destinations globally. Spring has arrived in Japan, and as the weather continues to warm up ahead of the cherry blossoms in March, this could rapidly change as bugs that hitched a ride during the winter start to multiply. To read this article in full, please subscribe on PATREON or contact me for a sample using the CONTACT FORM. Some observations and thoughts on the Japanese market for January 2024 and into March.

And a big month for Japan in space. To read this article, please click HERE Ah yes, I remember it well! This is the second time I have seen the Nikkei 225 heading for 40,000.

An interesting session on the replay before I joined Money Talk last Friday, with Andrew Freris CEO of Ecognosis Advisory, and Mark Michelson, Chairman of Asia CEO Forum at IMA Asia, with RTHK's James Ross to discuss the following:

Thank you to everyone who gave me such positive feedback on my recent articles, and thank you to James Ross for inviting me on the show for the discussion. Best, Neil The Man On The Telly - BBC Singapore Asia Business Report 19th February, 2024

To read this article in full, click HERE a formatted PDF sample of this article is available, please ask. Links to articles: CNN Business – “Despite a recession, Japan’s stocks are partying like it’s 1989” BBC – “Japan unexpectedly slips into a recession” To join the mailing list, please leave a message via the CONTACT form with your preferred Email address. |

JAPANMACRO is published on

Patreon and Substack As always, please read the IMPORTANT DISCLAIMER on the ABOUT Page. JAPANMACRO is a subscription service for individual investors. For institutional subscription packages please visit ASTRIS ADVISORY or send me a message on the contact form. For a list of topics covered click HERE Who am I? Neil Newman |